Reference for Downloaded Rating Matrix Data

Data Layout

| Date | Code of rating agency |

Name of rating agency |

Remaining years |

Credit rating |

Compound Yield |

Standard deviation |

Number of Issues |

Number of Reporting data |

| 9(8) | 9(3) | X(40) | 9(2) | X(6) | -ZZ9.9ZZ | Z9.9ZZ | ZZZZ9 | ZZZZZ9 |

Commas used to mark off each item

Image of downloaded data

| Column | Item |

|---|---|

| A | Date |

| B | Code of rating agency 1: Rating and Investment Information, Inc 3: Japan Credit Rating Agency, Ltd. 5: Standard & Poor's |

| C | Rating agency name |

| D | Remaining years (Note1) |

| E,J,O,T,Y,AD | Credit rating |

| F,K,P,U,Z,AE | Compound Yield (Note 2) |

| G,L,Q,V,AA,AF | Standard deviation (Note 3) |

| H,M,R,W,AB,AG | Number of issues falling under categories (rating, time to maturity)(Note 4) |

| I,N,S,X,AC,AH | Number of the designated reporting members of these issues (Note 5) |

Note1

For example, "2" in D column means 2 years or more but less than 3 years. "1" in D column means less than 2 years, and "20" in D column means 20 years or more.

Note2

Calculation method for compound interest yields in the rating matrix

- Unit prices are calculated based on the reported values submitted from each designated reporting member. Compound interest yields are then calculated based on these Unit prices.

- Averages of these compound interest yields are posted in the table.

Note3

Standard deviation calculation procedure

Standard deviation is calculated from the following formula with each compound interest yield of each reported data, the average of the compound interest yields calculated above and the number of reported data.

s2 = {(x1 - X)2 + (x2 - X)2 + ・・・ + (xn - X)2} ÷ (n - 1)

s : standard deviation・・・ calculating square root of s2

n : the number of reported data

x : each compound interest yield

X : average of compound interest yields

* Standard deviation is calculated to seven decimal places.

* In case that the number of reported data is only one, 0 is posted in the standard deviation columns.

Note4

Calculations are made for issues for which Reference Statistical Prices [Yields] for OTC Bond Transactions of are published and are rated by a rating source.

Note5

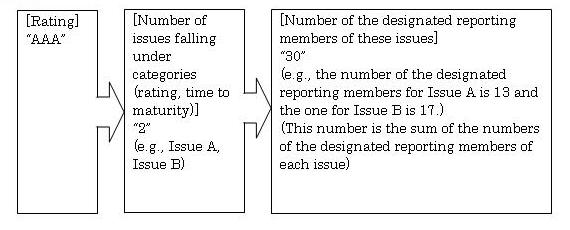

For example, in case "AAA" is placed in E column, 2 in H column and "30" in I column,

* If you are opening the downloaded CSV data with Microsoft Excel, please use this Item List.